Yesterday I discussed the efficient market theory and excess risk-adjusted returns. The theory says you cannot consistently achieve such returns. However, an 'excess return' means an excess over the risk-free rate. The risk-free rate is a return that is absolutely guaranteed (because it is risk-free!) and which you can get by lending money over a period of time. Today I shall examine why there is a risk-free rate at all. Tomorrow I shall examine whether, given its root cause, we have a moral entitlement to receiving it.

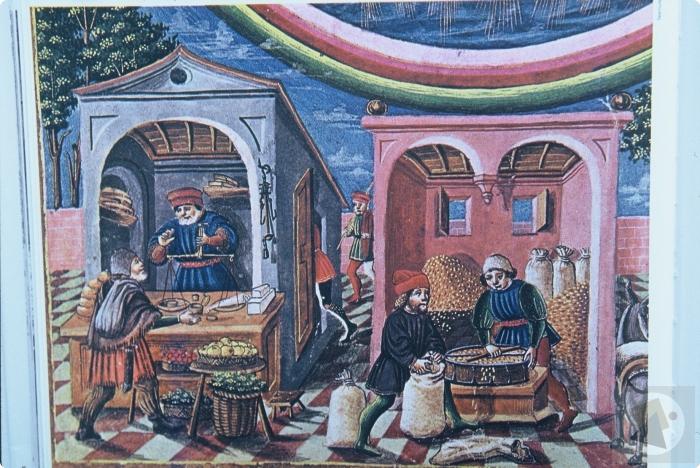

Yesterday I discussed the efficient market theory and excess risk-adjusted returns. The theory says you cannot consistently achieve such returns. However, an 'excess return' means an excess over the risk-free rate. The risk-free rate is a return that is absolutely guaranteed (because it is risk-free!) and which you can get by lending money over a period of time. Today I shall examine why there is a risk-free rate at all. Tomorrow I shall examine whether, given its root cause, we have a moral entitlement to receiving it.The root cause of the risk-free rate is time preference for money or goods. Would you prefer to have something now, or in a year's time? No one is indifferent to waiting, and everyone would prefer to have something now, rather than later. However, many physical goods we have to wait for, such as a crop. Time preference suggests that the value now of a crop that will be harvested in a year's time will be less than its value in a year's time. Thus if I wish to sell you that crop for future delivery, even if we are agreed that its value then will be £100, its value now will be less than that - say £95. Banking originally grew out of the practice of selling grain-sale rights at such a 'discounted' price against future harvest, in Lombardy in the Middle Ages.

Note that discounting does not of itself involve lending as such. We are buying future goods from the farmer with hard cash, who can walk away with the money as his own, with nothing to return. But its implication for lending is obvious. The 'law of one price' ensures that the risk-free rate and the discount rate converge. If the discount rate is higher, then I can borrow at the risk-free rate, buy future goods at the discount rate, and make a guaranteed profit. If it is lower, then I can sell future goods, and invest at the risk-free rate, with guaranteed profit. If everyone understands this - as the efficient market thesis says they will - the two rates will converge.

In summary, time preference - the preference for value now rather than the same value in the future - leads to discounting. Discounting in turn (via the law of one price) leads to money having a sort of intrinsic value. None of this involves any ethical judgment, merely observations or facts about human behaviour. Tomorrow I will ask whether we are morally entitled to receive this time-value from money.

No comments:

Post a Comment